From GPT-4o to GPT-5: How Claira Is Powering the Future of Private Credit Analysis

Efficiency and Insight Through Smarter AI Integration

At Claira, we help investment teams streamline their processes through greater efficiency, stronger results, and deeper analysis, evolving how decisions are made in private credit. The industry still relies heavily on manual tasks that can be automated, and we are committed to addressing this challenge as we grow alongside advancements in AI technology.

We’re excited to share that we have begun integrating the newly released GPT-5 model into our agent and platform, moving beyond GPT-4o which was already delivering strong results for our clients. As we continue to grow, we grow together with our clients, embracing AI as it becomes an integral part of financial services.

As advanced as these AI models are, simply having access to them isn’t enough. The real advantage comes when AI is embedded directly into the investment team’s workflow – not when teams must leave their process to go find it.

That’s why Claira serves as the workbench for analysts and the investment team, with a complete focus on the Investment Committee (IC) workflow. The adoption of GPT-5 gives us a clear opportunity to compare outcomes with GPT-4o and see first-hand how this leap in technology further enhances our ability to help transform the private credit industry.

From Faster Insights to Deeper Analysis: How Claira uses GPT-5

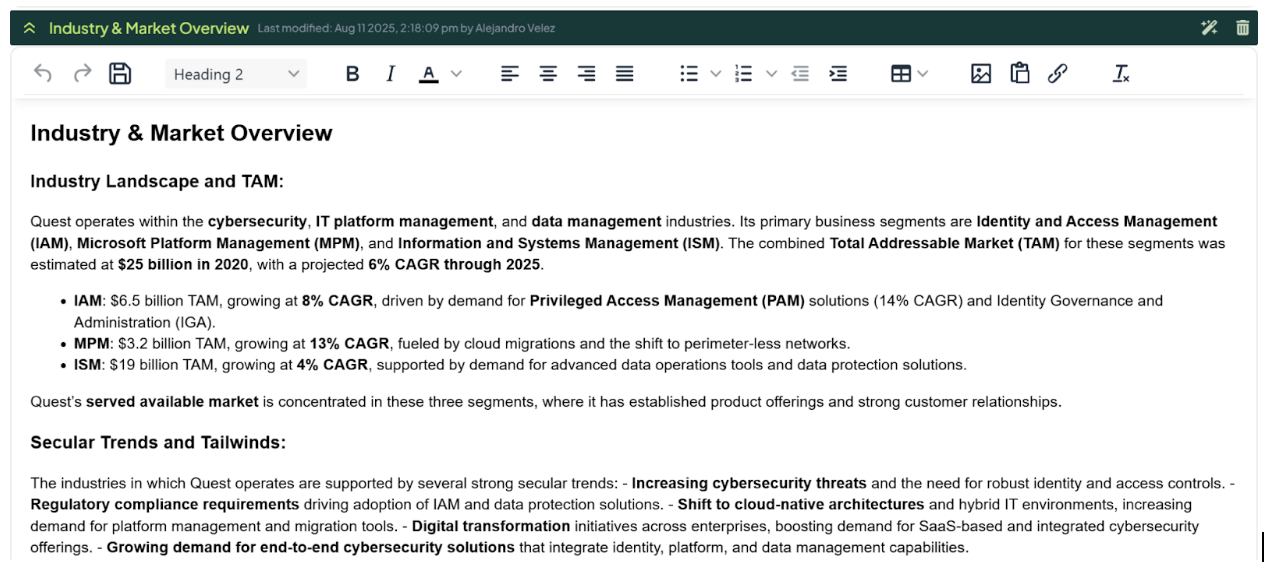

We have developed custom prompt templates that support multiple stages of the investment process, ensuring all necessary information is captured to advance due diligence on active deals. These templates are a core feature of our platform, allowing users to upload documents and extract key information for their analysis. With GPT-4o, these results were already being seamlessly integrated into CIM overviews and investment memos prepared by analysts. Now, with GPT-5, we are seeing measurable improvements:

Faster turnaround: Information is extracted more quickly from all uploaded documents, including PDFs, Excel spreadsheets, and Word files, and is condensed into clear company overviews.

Greater descriptive depth: Prompts now deliver richer, more detailed analyses tailored to the specific information requested. This enhanced output enables analysts to develop a deeper understanding of each company.

ChatGPT-4o

ChatGPT-5

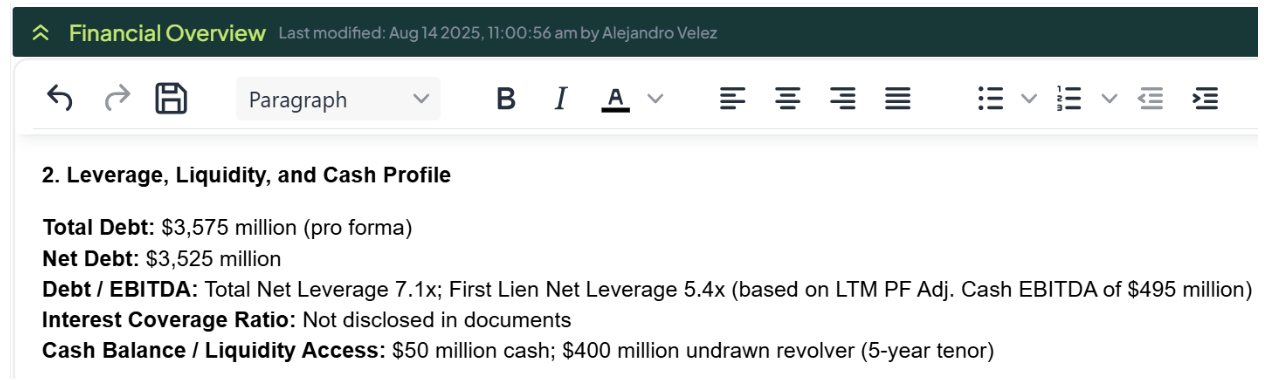

Improved financial accuracy: Figures that previously went undetected by our agent can now be captured from more tables, embedded images, and other sources within the files. This results in more complete and accurate financial data for analysis.

ChatGPT-4o

ChatGPT-5

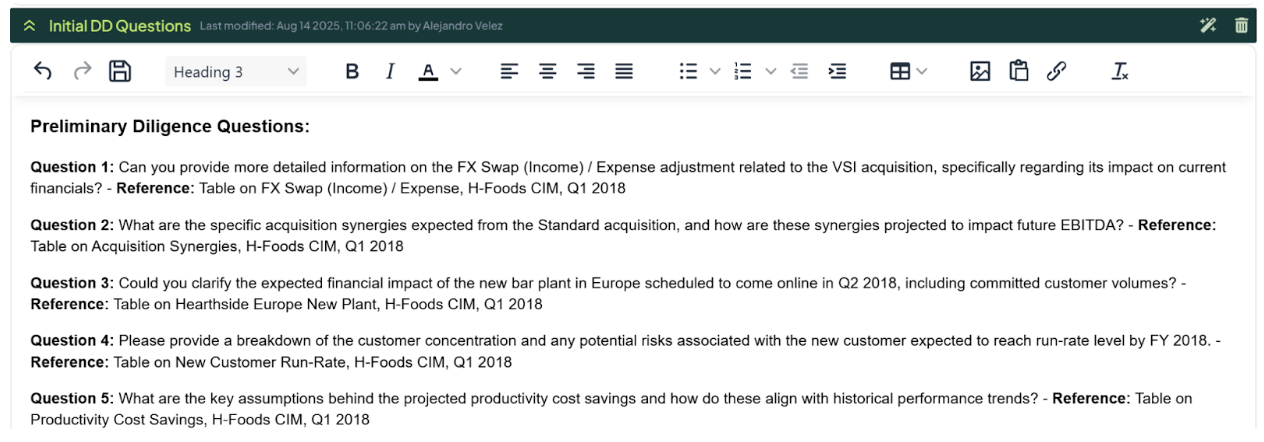

Enhanced traceability: Outputs now include clearer references to the original document and page where the information was found. This makes it easier to build due diligence checklists, identify information gaps, and prepare targeted questions for management or the sponsor team.

ChatGPT-5

Real-World Impact on Private Credit Teams

At Claira, our focus has always been on creating tools that directly improve the work of private credit professionals. The enhancements brought by GPT-5 are already translating into tangible benefits for analysts and deal teams. We are seeing teams move through diligence more efficiently, uncover details that were previously overlooked, and prepare more complete memos for investment committee. By reducing the manual effort in gathering, verifying, and organizing information, analysts can dedicate more time to deeper analysis and strategic decision-making, exactly where their expertise creates the most value.

Conclusion: Claira’s GPT-5 Integration Is Changing the Game in Private Credit

Yes, GPT-5 is powerful—but in private credit, the real measure of value isn’t just model accuracy. It’s how much more productive and effective investment teams can be. That’s why simply “having AI” isn’t enough. The real advantage comes when AI is built into your process, not bolted on.

That’s why Claira serves as the workbench for analysts and the investment team, with a complete focus on the Investment Committee (IC) workflow, directly incorporated into the iterative and collaborative process that happens when evaluating investment opportunities.. We’re not an “AI-first” investment analyst tool—we’re a deal intelligence platform that uses AI, along with other technology, to make the IC process more efficient, effective, and insight-driven.

In a market where technology is evolving at breakneck speed, investment teams shouldn’t have to waste time separating hype from reality. Or figuring out how and when to implement the latest tools. Claira does that work for you—bringing the most impactful capabilities, like GPT-5, directly and quickly into day-to-day decision-making.

The combination of faster insights, richer analysis, and improved accuracy is not just an upgrade in technology—it’s an upgrade in how decisions are made.